/financial-advisor-talking-to-couple-on-sofa-175139840-59ac6878685fbe0010301fae.jpg)

#Best free financial software retirmenet plus#

TurboTax Plus software offers assistance from tax experts to give your personalized advice and can help you maximize your deductions by analyzing expenses and taking advantage of deductibles and credits you may not know about. TurboTax offers a free version of its software if you only need to file a Federal 1040EZ or 1040A, but paid versions offer more tools for entrepreneurs and contractors. If you’ve used TurboTax before to file your taxes, the software offers intra-version compatibility and remembers much of the information you’ve entered from previous years to speed up the filing process.

#Best free financial software retirmenet android#

TurboTax’s fluid and intuitive design makes entering your tax information easy-the software even offers iPhone and Android compatibility, which allows you to snap photos of your W-2 forms to quickly enter the information automatically. Okay, most people probably won’t need TurboTax during the majority of the year, but the tool earned its place on our list for its powerful use during tax season. Price: Free, but premium feature prices vary Who’s it for? Those looking for a low-cost tax preparation option that offers additional support and features More than 70,000 financial professionals across firms of all sizes use the eMoney platform to serve more than 4 million households throughout the U.S. By using eMoney, financial advisors are able to bring client conversations to life with interactive and collaborative experiences that promote engagement and utilization, and foster deeper understanding and stronger relationships.ĮMoney’s solutions and services enable advisors to plan across the client lifecycle, engage clients meaningfully, manage their practice efficiently and effectively, streamline technology, and grow their business.

As client needs evolve, eMoney’s scalable solutions allow financial advisors to easily graduate them from a streamlined, goals-based approach to the industry’s most sophisticated advanced planning solution-all from a single platform.

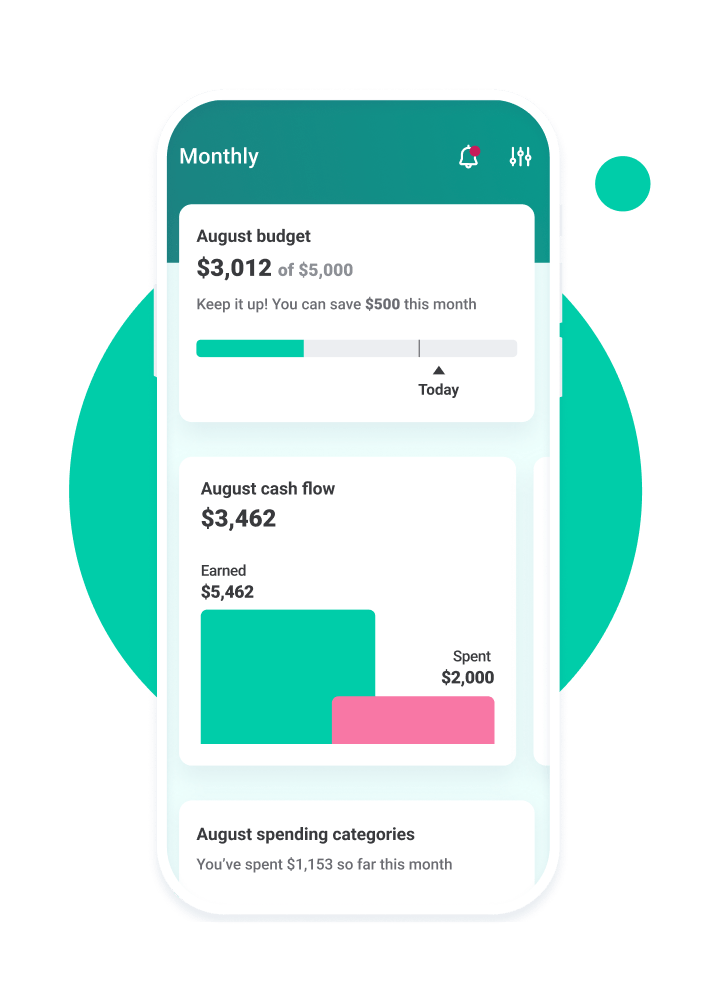

Who’s it for? Financial professionals, firms, and enterprises of all sizesĮMoney Advisor provides a comprehensive planning-led platform that offers a different kind of experience and takes planning relationships to the next level. Mint is best used by younger investors, personal finance newbies, and those who frequently find themselves racking up late fees or interest because they have trouble keeping track of all of their accounts. While the platform offers only simple budgeting and finance tools, its simple design makes it easy for even new budgeters to get started. Mint’s software is totally free and available on both desktop and mobile. The software also helps keep users accountable by allowing them to enable alerts and push notifications for things like low balances, incoming minimum bill payment dates and overdraft notices, which can help you avoid paying expensive late fees or accruing interest on credit cards. Mint allows you to input your banking and credit card information, and the software automatically analyzes your finances and pinpoints areas in which you can cut back to save money. Popular among millennials, the Mint app has attracted over 20 million users in just over a decade of operation thanks to its easy-to-use platform and hands-off approach to investing. Who’s it for? Personal finance who prioritize their mobile experience Personal Capital’s software is free, but you’ll need to pay an additional fee to access some of its wealth management tools. Personal Capital offers both desktop and mobile app compatibility, which makes it simple to track cash flow and expenses no matter where you go. You can move between bank accounts with a single click or swipe and the software also offers comprehensive retirement planning advice (including a calculator to determine how much you need to save annually to retire on time), a fee calculator to identify where you’re losing money on overdraw and late fees, and budgeting tools that allow you to organize expenses by date, type, and transaction amount. Personal Capital is an account aggregation software that offers users a single solution to coordinate multiple bank accounts. Who’s it for? Beginning-to-intermediate planners who want an affordable way to coordinate their accounts

0 kommentar(er)

0 kommentar(er)